DeltaSignal CD Index 2025 · Top 5: Miners & Energy

Bitcoin Miners Turn Into Banks: The $15 B Crypto Shift

About DeltaSignal’s Crypto Disclosure Index

DeltaSignal’s Crypto Disclosure Index (CDI) is a proprietary scoring system built from SEC XBRL filings. It measures how deeply public companies integrate crypto assets into their balance sheets and operations.

This edition ranks the five leading mining firms. Together they hold more than 15 billion dollars in crypto assets and show how mining is evolving into banking.

Something changed inside mining

Mining companies are no longer only producing Bitcoin.

They are holding it, lending it, and routing it through internal financial systems.

Our review of 315 corporate SEC filings surfaced over 15 billion dollars in crypto assets on mining balance sheets.

One top miner now tracks about 1,900 crypto XBRL tags within its own reporting framework, a level of precision rare even in traditional finance.

This is a structural shift. The line between miner and bank has blurred.

The filings are public. The pattern is not.

🔺 What matters now is which companies have crossed that line, how deep their exposure runs, and how that leverage will reshape returns in the next earnings cycle.

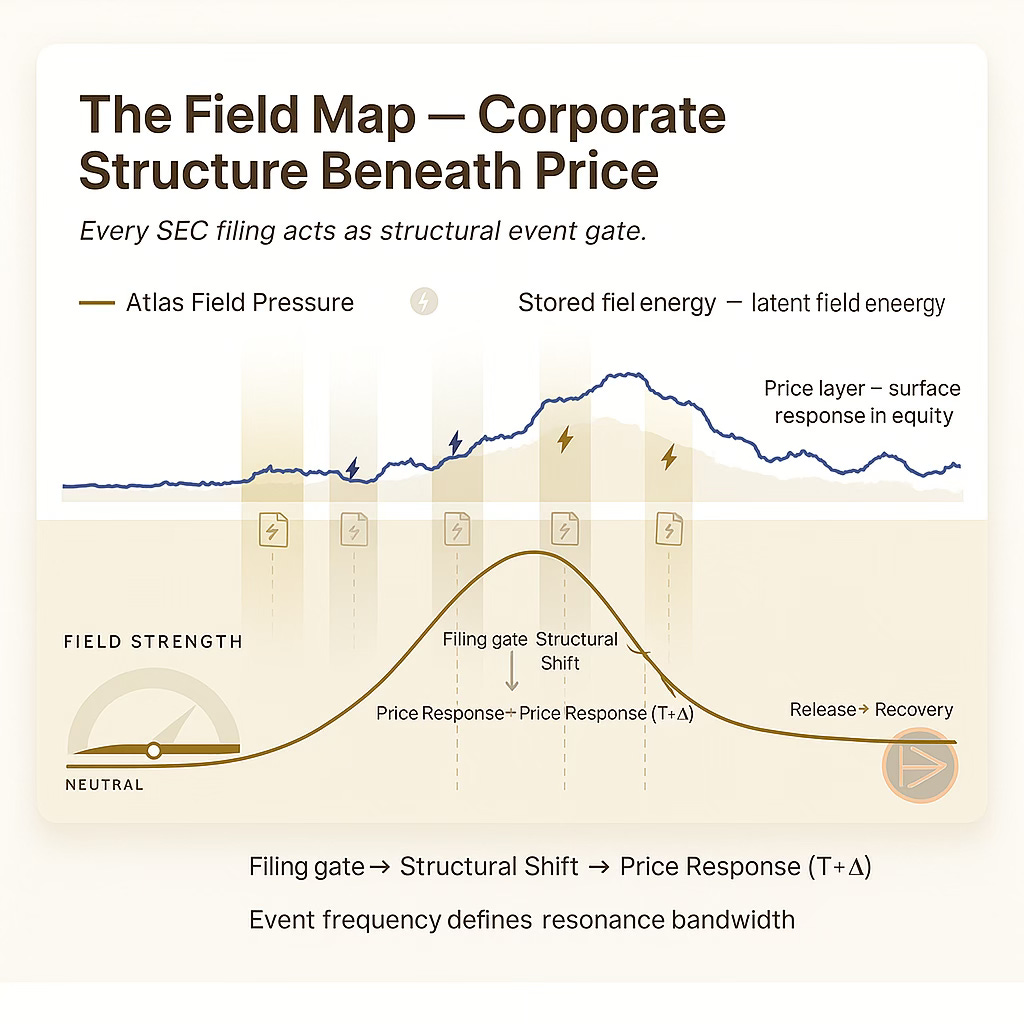

Every SEC filing acts as an event gate. Price is the echo; structure is the cause.

Public markets move in visible waves - prices, volumes, sentiment. But beneath that surface is a slower, deeper field: the structure of corporate disclosures themselves.

How DeltaSignal’s CDI Score Works

Our Crypto Disclosure Index measures how deeply a company integrates crypto into its business. It is driven by data, not opinion.

Each score blends three inputs:

• Treasury Value: how much crypto sits on its balance sheet.

• Operational Sophistication: how detailed its crypto reporting is in SEC filings.

• Business Integration: whether the company uses crypto for treasury, collateral, or custody.

Larger treasuries and more integrated operations push scores higher.

Companies that treat crypto as a full financial layer, not just an asset, rank at the top.

These scores also function as foresight signals:

⇢ When collateral balances expand, liquidity is building.

⇢ When namespaces multiply, infrastructure is forming.

⇢ When treasury values surge, equity leverage tightens before the chart does.

🔺 All data is drawn directly from SEC XBRL filings. No estimates. No third-party feeds. Every figure is verifiable in EDGAR.

Value-weighted scoring. Billion-dollar treasuries drive rankings 25 to 125 times more than tag counts.

Inside the Mining Balance Sheet

Five public miners now control over 15 billion dollars in crypto assets.

They form the financial core of Bitcoin’s corporate adoption layer, and their filings act as early indicators of where liquidity and leverage will move next.

In Q2 2025, one mid-cap miner increased its collateral accounts by 14 percent. Within three weeks its stock re-rated 17 percent as new debt financing was announced.

CDI flagged the shift before analysts modeled it.

That is what makes the Index predictive. Filings move first. Prices follow.

The principle is simple: scale + sophistication + integration = foresight.

Value-weighted. Billion-dollar treasuries drive rankings 25 to 125 times more than tag counts.

👉 We tracked the filings of Marathon (MARA), Hut 8 (HUT), and three other public miners holding billions in crypto assets. Premium members see who moved first, the details, and what they signal next.